Article by Stéphane Levy, Strategist and Head of Innovation, available in full on the L’Agefi website.

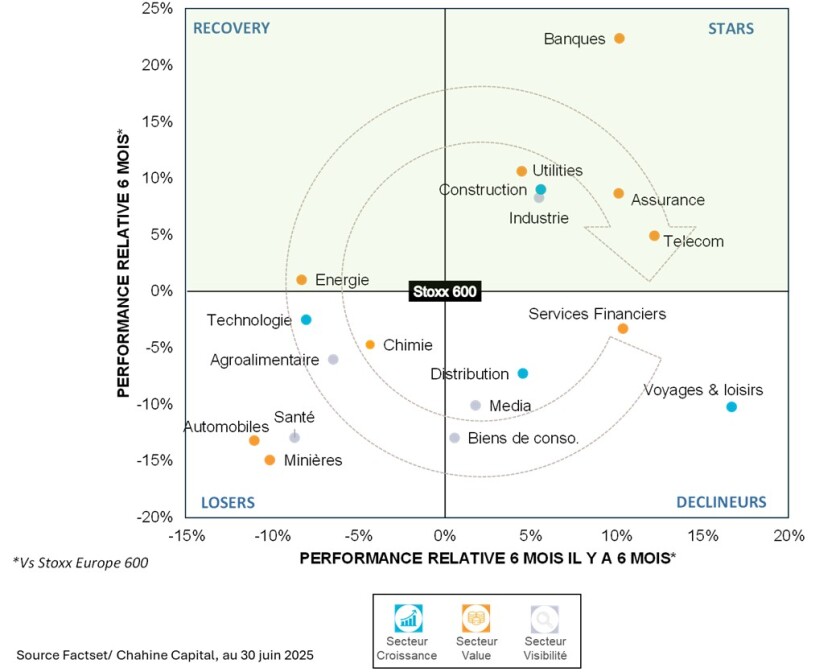

The stock market rally that began nearly three years ago continued during the first half of the year. The MSCI Europe NR rose 8.5% in euros, despite particularly intense political and geopolitical news. This increase did not affect all segments of the European market, and a powerful and atypical dispersion of performance was observed.

For example, the banking sector rose 29.1% in the first half of the year, while the consumer goods and healthcare sectors both fell 6.3%.

The rise of the euro and the ongoing saga of customs tariffs favoured domestic segments

This is a perfectly understandable and logical phenomenon in what could be the third and final phase of the stock market rally that began in autumn 2022.

The first phase, between September 2022 and October 2023, was one of relief linked to the economic cycle. The global economy proved much more resilient than anticipated, despite double-digit inflation at the time.

The second phase, between October 2023 and December 2024, was the positive consequence of the rapid decline in inflation and the imminent accommodative monetary pivot by central banks, which materialised in June 2024 for the ECB and September 2024 for the Fed.

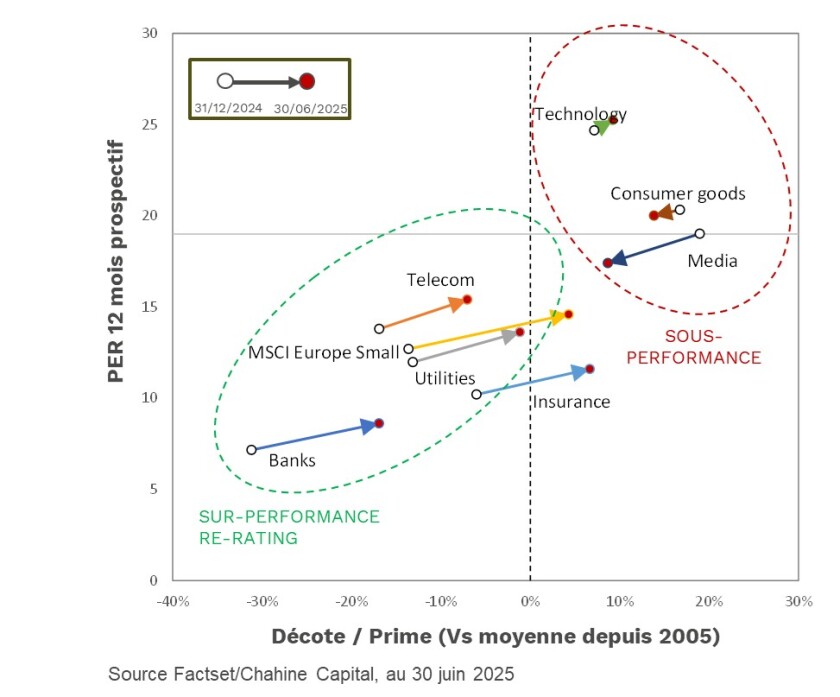

The third phase, which has been underway since the beginning of the year, is one of fundamental normalisation across the various segments of the equity market. This phenomenon is traditionally observed at the end of an expansionary cycle.

Fundamental normalisation has boosted value

This is why value stocks and small and mid caps performed well during the first half of the year. At the beginning of the year, all value-dominated sectors, i.e. low-valuation sectors, were trading at a discount to their historical valuation standards. This is now less true. Conversely, ‘expensive’ sectors, particularly visibility sectors (agri-food, consumer goods, healthcare, media), had a valuation premium at the start of the year, which has gradually normalised due to their significant recent underperformance.

This fundamental normalisation in the first half of the year also boosted the most domestic market segments in Europe. This comes as no surprise in a political context dominated by the threat of tariffs from the new Trump administration. This is all the more true given that the euro has appreciated significantly against the dollar, which has weighed relatively heavily on exporting companies.

Banks, insurance, telecoms and utilities stood out because these sectors combine value and domestic characteristics, unlike consumer goods, healthcare and automotive sectors.

More diversified momentum in the second half of the year?

The normalisation process has been such that the fundamental inconsistencies we identified at the beginning of the year have now largely been resolved. It would therefore not be surprising to see a gradual shift in momentum, which is currently highly polarised, towards segments that are currently neglected in the coming months.

Some sectors have underperformed to such an extent that they are becoming attractive again. These include agri-food, healthcare, consumer goods, luxury goods and automotive.

One catalyst for this scenario could be a larger-than-expected interest rate cut by the US Federal Reserve in the second half of the year, which would allow the US administration to ease its grip on tariffs.